defer capital gains tax canada

As a result of the 1031 Exchange real estate investors may sell rentals in the United States. In our example you would have to include 1325 2650 x 50 in your income.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor.

. From selling one property to another capital gains tax is deferred. Since it will include your departure date the change will be confirmed when you file a final tax return by April 30 of the year following the one you left Canada. Capital gains may be claimed if you are resident of Canada.

148 In some cases where a taxpayer disposes of a former business property to a taxable Canadian corporation and a subsection 85 1 election is made a capital gain may result. The corporations must be Canadian-controlled and must do most of their business in Canada. For example you may sell a capital property for 50000 and receive 10000 when you sell it and the remaining 40000 over the next 4 years.

So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time. Comments for Deferal of capital gains tax in Canada. How Long Can You Defer Taxes In Canada.

It is required that the form T-2017 page 3 in schedule 3 be submitted by you and with your personal tax return for the year of sale in order to claim this reserve. When you sell a capital property you usually receive full payment at that time. To qualify both investments must be common shares of small business corporations.

In Canada 50 of the value of any capital gains is taxable. The election provides farmers with the opportunity to not incur a tax liability immediately at the time of the sale transaction. Click here to add your own comments.

Investors in real estate can defer paying capital gains taxes on rental properties sold bought or transferred if they choose to sell them at a greater and higher price than they earned from the rental property. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act.

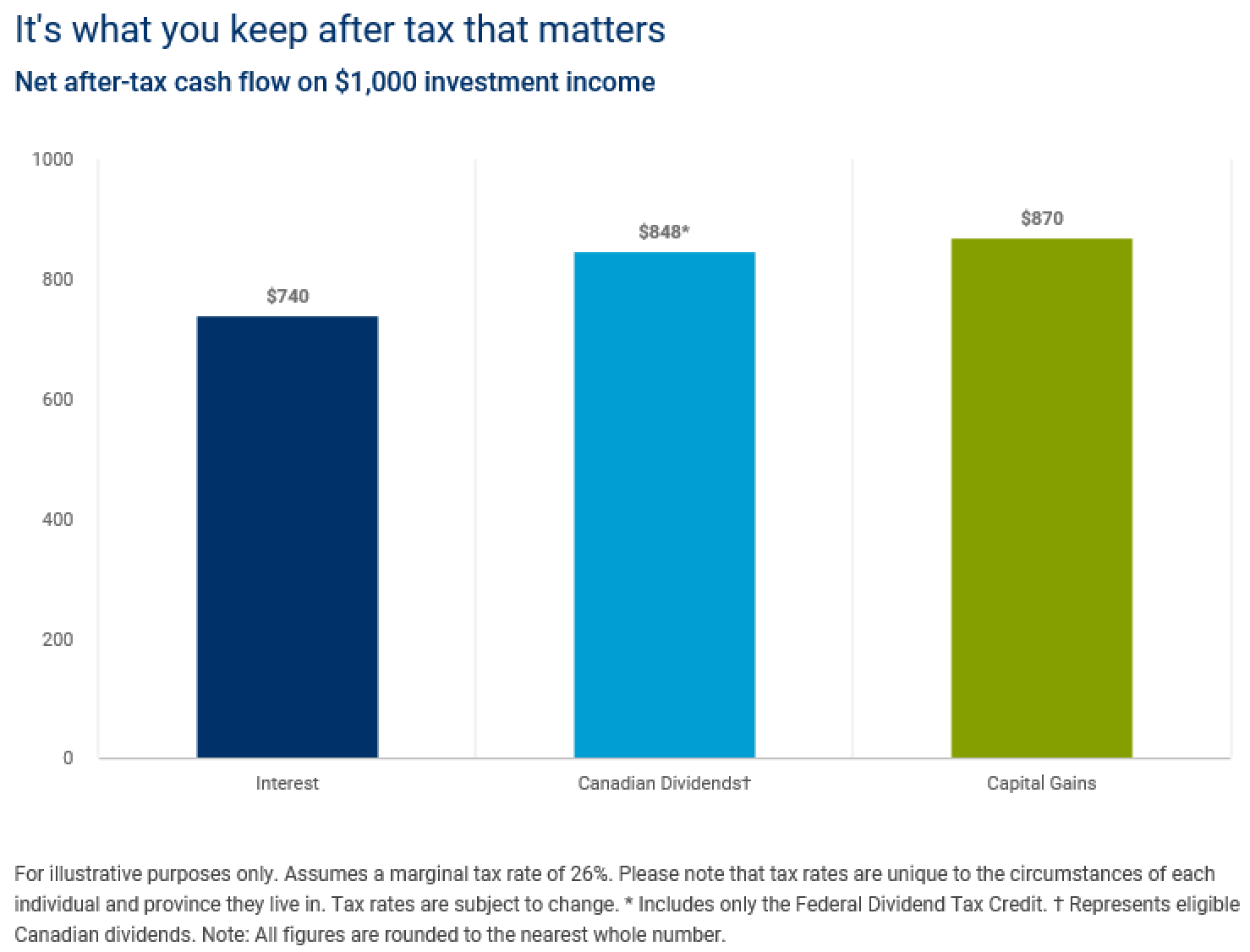

To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. The sale price minus your ACB is the capital gain that youll need to pay tax on. There are six ways to avoid capital gains tax in CanadaThe tax shelters serve as a place to keep money and to file taxesLosses in capital are offset by capital gainsIncrease capital gains over previously realized amountsThis tax exemption does not apply to life-long capital gainsYou can donate your shares to charity by purchasing themIn addition to capital.

Since the government is currently running substantial deficits there has been speculation among politicians and officials that the capital gains tax rate is likely to increase in the years ahead. The Canadian Chamber of Commerce recommends that the federal government. However sometimes you receive the amount over a number of years.

The adjusted cost base ACB of the new investment is reduced by the capital gain deferred. The future of capital gains tax. The tax authorities treat this final tax return much like they would treat the tax return of a deceased person says Poitras.

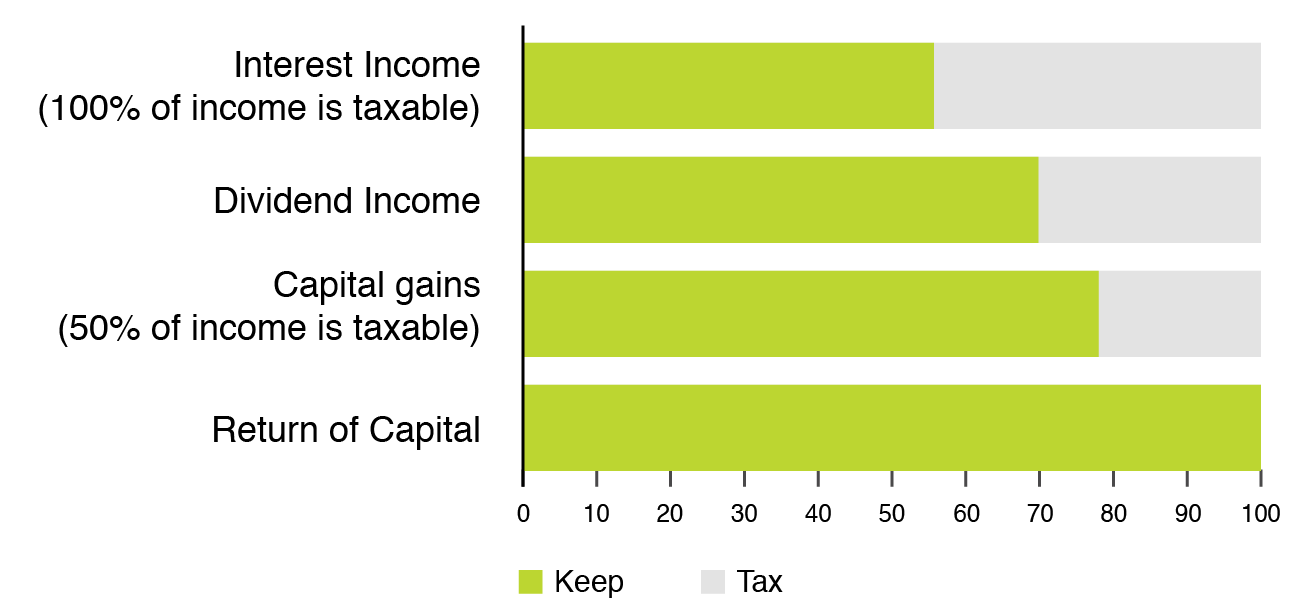

Without deferring the earnings youd owe approximately 24480 in taxes in the first year recognizing your earnings plus the full capital gain in. As of right now capital gains are only 50 per cent taxable which means the other half is tax-free. In such case a deferral of this gain is available pursuant to section 44 provided that the requirements of that section are otherwise met.

Capital gains deferral for investment in small business. However if you use only a quarter of the proceeds of the disposition to make your new investment you only receive a deferral equal to a quarter of your capital gains. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States.

This article was originally published on July 31 2017 and has been updated. We do not have such a chance for deferral in Canada right now. If you sell qualifying small business corporation shares you can defer reporting your capital gains if you invest the proceeds of the sale into another eligible investment.

The amount of tax youll pay depends on how much youre earning from other sources. This deferral applies to dispositions where you use the proceeds to acquire another small business investment. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

Capital gains can be deferred for up to five years by claiming this reserve. Section 44 applies to a property that. Canada does not have capital gains tax deferral rules like the US does 1031 exchange.

A like-kind exchange along. Create a tax and regulatory environment that promotes the building of new affordable housing by allowing investors to defer CCA recapture and capital gains on the proceeds from the sale of rental property when the proceeds are reinvested in another rental property within a reasonable. 4 FINAL TAX RETURN AND TAX DEFERRAL.

You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce. If you use all or more of the proceeds from selling the shares in your business to buy new qualifying investments you can defer 100 percent of your capital gains. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

In Canada you only pay tax on 50 of any capital gains you realize. Replacement property tax rules permit farmers to defer capital gains tax until the subsequent disposition date of the newly purchased property. Claiming a capital gains reserve.

This can reduce your income tax significantly.

How Do I Report Capital Gains In British Columbia

Starlight Capital Tax Treatment Of Distributions

Turning Losses Into Tax Advantages

How To Prepare Financially For A 6 12 Month Career Break Money Management Activities Fire Movement Career

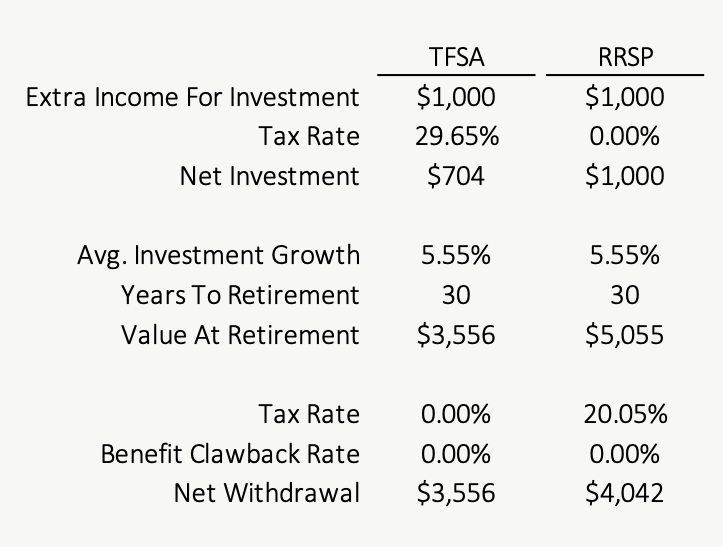

Tax Deferral Is Not Necessarily An Advantage Planeasy

What Is An Etf And Are Etfs A Good Investment Good Money Sense Money Sense Investing Investing Money

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Complete Guide To Canada S Capital Gains Tax Zolo

Savings Hierarchy Savings Strategy Financial Planning Hierarchy

Vanguard Inflation Protected Securities Fund Investing Protect Security Reading

Whitehead Wealth Management Blog 11 Non Registered Accounts And Taxes

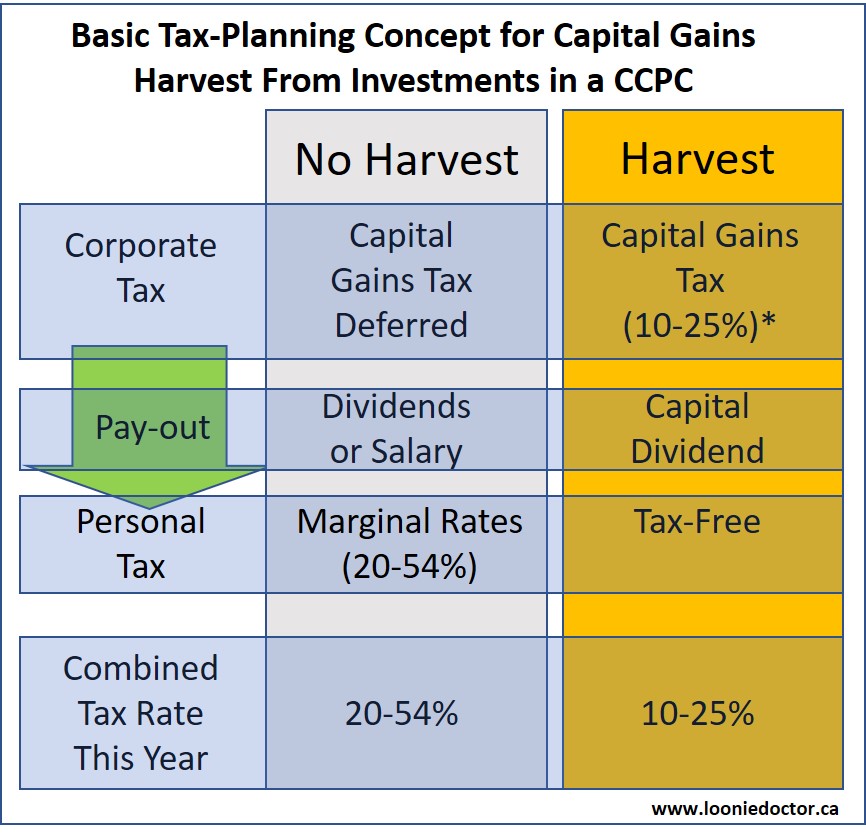

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Checks In The Mail Online You Create We Print Mail 1 In 2021 Emojis Meanings Unemployment Meant To Be

How To Defer Capital Gains Tax On Real Estate Canada Ictsd Org

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Complete Guide To Canada S Capital Gains Tax Zolo

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada