Fringe benefit

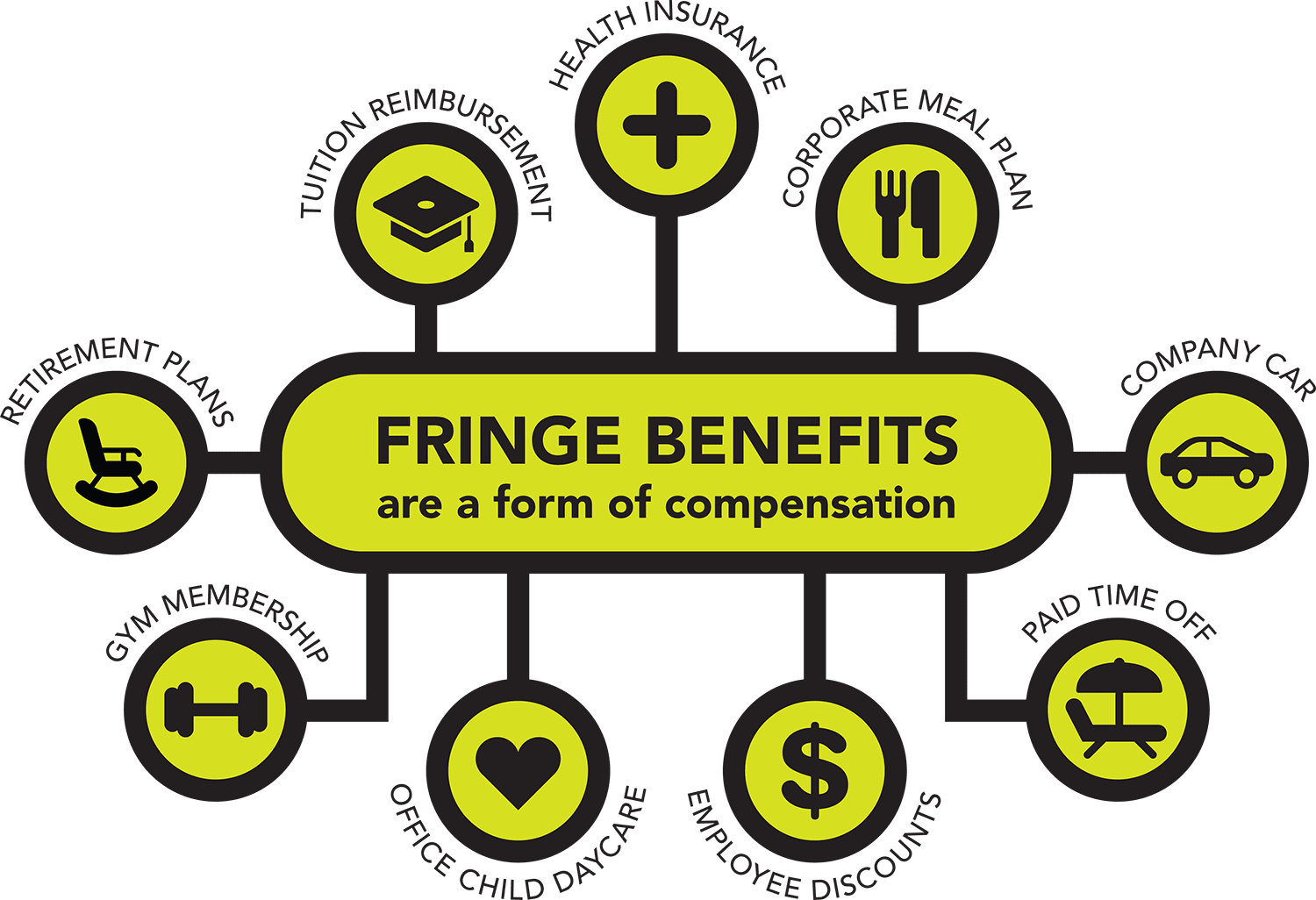

Cosè il fringe benefit e chi può ottenere il bonus fino a 3000 euro. Fringe benefits are a form of compensation that employers give to team members in addition to their regular salary.

What Are Fringe Benefits How Do They Work Techitalents

La norma è stata inserita nel decreto Aiuti quater approvato ieri in Cdm.

. Fringe is the only platform youll need for lifestyle benefits employee wellbeing rewards and recognition peer-to-peer giving employee donations recruiting incentives and so much more. And in most cases the IRS wants you to use. 535 and Regulations section 1274-12.

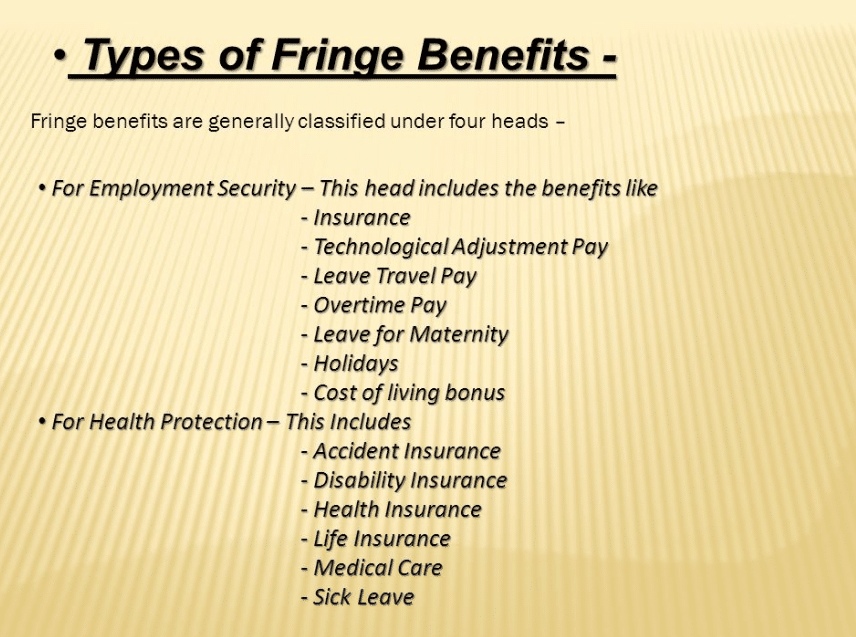

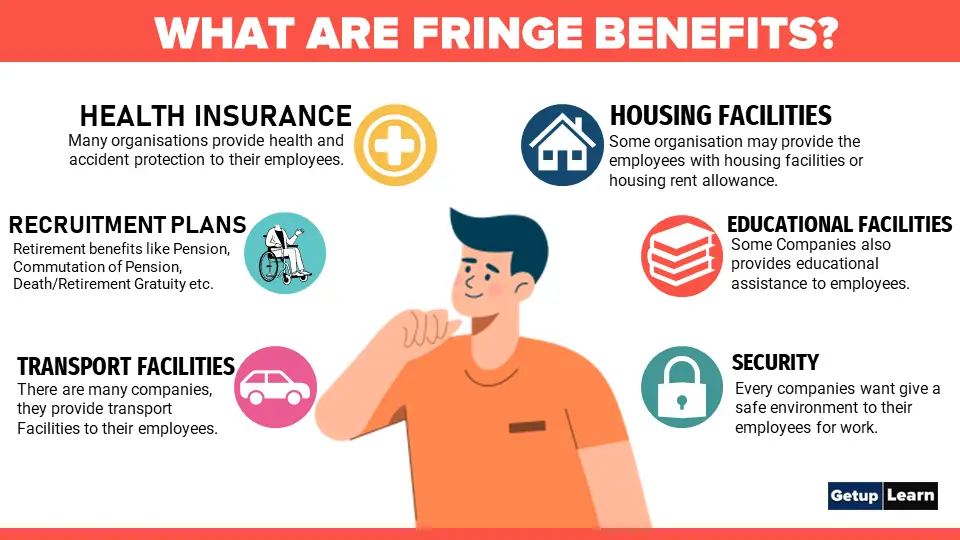

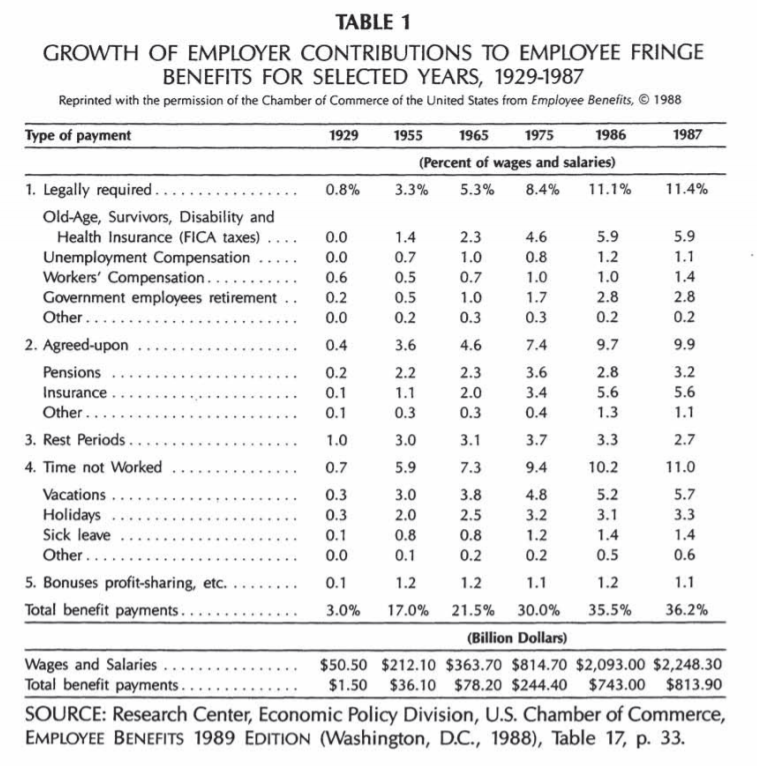

A fringe benefit is a form of pay for the performance of services. We know you have other more valuable business activities to concentrate on. Fringe benefits are advantages that are provided by the employer to an employee over and above the normal salary and wages which may be in the form of cash.

Exclusion for Certain Employer Payments of Student Loans -- 29-MAY-2020. Some fringe benefits such as social. Noun an employment benefit such as a pension or a paid holiday granted by an employer that has a monetary value but does not affect basic wage rates.

These include health insurance family and medical leave workers. So any monetary benefit an employer offers in exchange for an employees services that does not include their. The Crossword Solver found 30 answers to fringe benefit 5 letters crossword clue.

There are many different types of fringe. Fringe benefits are benefits in addition to an employees wages. Fringe benefit soglia non tassabile per bollette passa da 600 euro a 3mila euro.

While your business deduction may be limited the fringe benefit exclusion rules still apply and the de. 2018-27 modifies the 6850 annual limitation on deductions for contributions to Health Savings. For example you provide an employee with a fringe benefit when you allow the employee to use a business.

For more than 30 years Fringe Benefit Group has designed programs that simplify the benefits process for employers with hourly workers. Il limite non tassabile era. For more information see chapter 2 of Pub.

At Fringe Benefit Plans our goal is to simplify your life by making benefit administration Hassle Free. We offer products from the. Some fringe benefits are so widely available that many workers consider them a normal part of a compensation package.

Its founder John Jack Wallace still heads the company in its over 40. For example an employee has a taxable fringe benefit with a fair market value of 300. Companies competing for the most in-demand skills tend to offer the m See more.

11 hours agoFringe benefits fino a 3mila euro con lAiuti Quater Il welfare aziendale esente IRPEF sale a 3mila euro comprensivi di utenze domestiche nella bozza del DL Aiuti Quater. Migranti la Ocean Viking in porto a Tolone Parigi. The type of salary or wage being paid will determine the type of fringes that apply.

Fringe benefits are the additional benefits offered to an employee above the stated salary for the performance of a specific service. Il governo Draghi aveva già alzato la soglia di questi bonus da 25823 euro allanno a 600 con il decreto. The Crossword Solver finds answers to classic crosswords and cryptic crossword puzzles.

Fringe benefits fringes are expenses directly related to an employees salaries and wages. You should reduce a benefit taxable amount by any amount paid by or for the employee. Definition of Fringe Benefits.

Benefit aziendali detassabili è come unaltra tredicesima Superbonus ha creato buco di 38 miliardi nelle casse. Here are examples of fringe benefits and their tax status. When employers provide taxable fringe benefits theyre responsible for calculating and recording imputed income for the employee.

Fringe Benefit Services Incorporated had its beginning in 1970 and was formerly known as Wallace Associates. Fringe benefits are additions to compensation that companies give their employeesIn any case employers use fringe benefits to help them recruit motivate and keFringe benefits help companies recruit motivate and keep high-quality employees. If an employee uses a company car for business and personal purposes the cost of this benefit is.

4 Ways To Calculate Fringe Benefits Wikihow

Fringe Benefit Stock Illustrations 198 Fringe Benefit Stock Illustrations Vectors Clipart Dreamstime

Payroll Systems What Are Fringe Benefits Payroll Systems

Raising Wages Versus Adding Fringe Benefits Small Business Trends

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

Fringe Benefit Payments Under The Ffcra Fca International

What Are Fringe Benefits It Business Mind

Working Condition Fringe Benefit Definition Examples More

Fringe Benefits Definition How They Work And Types

What Are Fringe Benefits Definition Needs Objectives Types

Fringe Benefits What Is Fringe Benefit What Is Fringe Benefit A Fringe Benefit Is Generally Defined As A Benefit Not Being Salary Wage Or Other Ppt Download

Fringe Benefit Plans Inc Employee Benefit Programs And Insurance

Fringe Benefits What Is Fringe Benefit What Is Fringe Benefit A Fringe Benefit Is Generally Defined As A Benefit Not Being Salary Wage Or Other Ppt Download

A Detailed Guide To Understanding Fringe Benefits Pyjamahr

Fringe Benefit Cartoons And Comics Funny Pictures From Cartoonstock

Free 5 Contractor Fringe Benefit Statement Samples In Pdf Ms Word

An Introduction To Fringe Benefits Smith Economics